TigerMark Case Study: Monogram Orthopedics

Monogram is a medical technology company ushering in the future of joint reconstruction. Combining 3D printing, machine learning, & robotics to create high precision implants.

www.monogramorthopedics.com

Series A (Regulation A/ 2020)

$14.6M / 7,000+ investors

Series B (Regulation A/ 2021) -

$23M / 14,064 investors

IPO (2023) -

Market cap $158.26M / (MGRM)

Partners Involved:

SUMMARY

Monogram recognized need for D&O insurance coverage that included meaningful investor protection. They engaged a top 5 insurance broker to advise and help with their insurance policies. Monogram faced extremely high D&O policy costs and their broker partner was unable to find insurance that included investor protection.

Our TigerMark policy allowed Assurely to negotiate below market terms and conditions since unaccredited risk exposure was covered by Assurely’s TigerMark D&O policy. Assurely manages all other insurance policies for Monogram.

MONOGRAM’S CHALLENGES

In addition to understanding the clear need for investor protection, Monogram faced two external factors that drove requirements to secure D&O coverage. In order to recruit and secure strategic board members, D&O coverage including investor protection was required. Additionally, D&O coverage with a $XM limit (retracted for privacy) was required to execute a contract with a strategic partner.

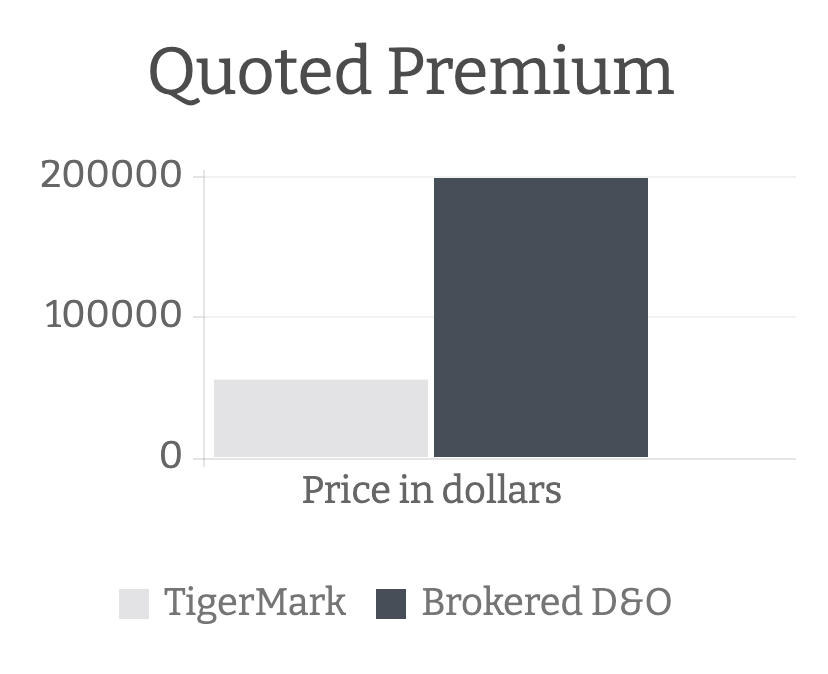

Monogram was presented with D&O quotes that a) had total policy limits that were 40% less than contract requirements b) excluded investor protection c) had a $1M deductible. The premium quoted was in excess of $200,000.

There is an 80% price delta between IPO and non-IPO premiums non-IPO premiums, on average, are $569K; IPOs are $1.02M. RELMs rates are -32.61 below market, and retention is 10x lower than market.

HOW ASSURELY’S TIGERMARK INSURANCE POLICY SOLVED THESE CHALLENGES

Assurely immediately placed a TigerMark insurance policy inclusive of investor coverage to address their immediate risks stemming from a Regulation A capital raise.

Assurely placed the additional $XM (retracted for privacy) of coverage in conjunction with the contractual requirement. The TigerMark insurance policy supported their investor risk needs, satisfied both their Board requirements and contractual obligations. It did not include a meaningful deductible. The custom program was all placed within two weeks and aggregate savings were 72% less premium while increasing the coverage levels.

Assurely continues to support Monogram’s current offering with customized coverage as they raise more capital and has supported their operational needs with ongoing servicing by providing proof of coverage, adding locations to support their growth and updating Monogram’s insurance portfolio to current to keep pace with their changing risks as they continue to grow and scale.

Results:

72% price decrease

Closed coverage gap left by traditional insurance policy

Provided required coverage to secure Board members and significant strategic contract

Get started today

Prefer to speak to someone in person? We’re here for you.

or give us a call: (478)-227-7873